Calculate Sales Tax Automatically

Some states require taxes to be collected on the sale of dental procedures or products. By setting up a procedure code in Dentrix specifically for sales tax, you can use it to automatically calculate tax in the Ledger.

To set up the tax/discount option:

- Open the Ledger and click File > Tax/Discount Options. The Tax/Discount Options Setup dialog box appears.

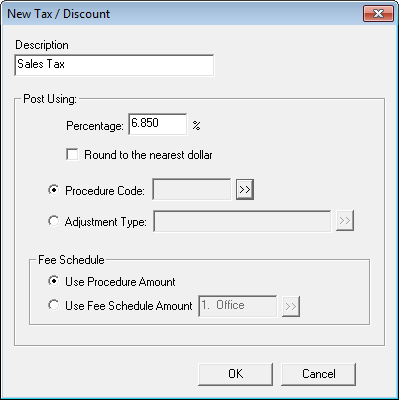

- Click New. The New Tax/Discount dialog box appears.

- In the Description field, enter a description of the tax option, such as "Sales Tax."

- In the Percentage field, enter the tax percentage.

- To collect the tax by using a procedure code for tracking, mark the Procedure Code radio button, and use the >> button to select the procedure code associated with the tax.

Note: For more information on how to set up a procedure code for tax, see knowledgebase article #15634 in the Dentrix Resource Center. Beginning in January, CDT 2014 will release and establish a code that should be used for tax purposes. - In the Fee Schedule group box, select Use Procedure Amount to calculate the tax based on the amount you are charging in the Ledger.

- Click OK to save your changes.

By following the above steps, the tax option is set for all workstations in your practice. To apply sales tax to a procedure/product:

- Open the Ledger and select a patient.

- Select the procedure(s) to which the tax will be applied.

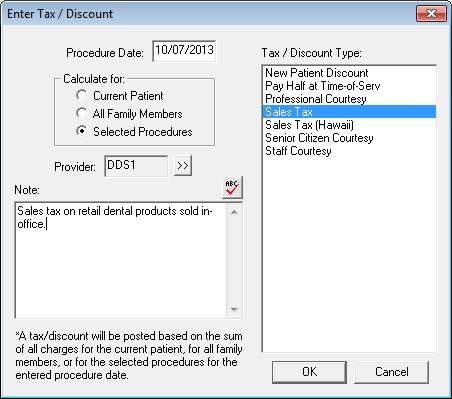

- From the Ledger toolbar, click the Enter Tax/Discount button. The Enter Tax/Discount dialog box appears.

- In the Calculate for: group box, mark the Selected Procedures option to only calculate the tax for the procedures selected in step 2.

- From the Tax/Discount Type list, select the type of tax you want to apply (i.e., Sales Tax).

- Select the Provider you want to assign the tax toward.

- Enter any notes pertaining to the tax in the Note field, if desired.

- Click OK. Dentrix calculates the amount of the tax and posts the charge to the account.

To watch a video of these steps, view the Dentrix Does It video titled "Applying Sales Tax". For more information about how to set up a procedure code for tax, log in to the Dentrix Resource Center and see knowledgebase article #15634.

Author: Sean Eyring

Published: 10/31/2013

Contact Us

Contact Us Phone:

Phone:  Email

Email Request Demo

Request Demo